New Food Economy: Bison bars were supposed to restore Native communities and grass-based ranches. Then came Epic Provisions.

by Marilyn Noble | November 27th, 2018

Tanka, a Native-owned business, invented the commercial bison bar. But Epic took credit, built an empire on a foundation of misleading claims, promised ranchers investment that never materialized, and left an industry struggling in its wake.

To hear the processed food industry tell it, the bison bar—the trendy, protein-dense snack now ubiquitous at high-end grocery stores across the country—has a clear, undisputed origin story. It was invented in 2011 by Katie Forrest and Taylor Collins, vegan endurance athletes who turned to meat to power their punishing training regimen. They got hooked on grass-fed bison, started making unusual bars from meat, dried fruit, and seeds out of their home kitchen, and quickly incorporated their obsession into a business. As co-founders of their new company, Epic Provisions, Forrest and Collins were smart and idealistic and naïve in all the right ways. Demand grew so quickly it’s almost as if they stumbled onto their defining moment: an acquisition by General Mills, to the tune of $100 million, that would launch countless imitators and have major implications for the American bison market.

The temptation to elide history in this way is understandable. The consumer packaged goods industry needs this story to make sense of itself. Perhaps more than any other product, bison bars illuminate the state of American processed food, and Epic exists at the intersection of several trends that food manufacturers are convinced are the key to their survival. There’s “snackification,” a fixation with convenience rooted in the suspicion that we’re all too busy to eat sit-down meals. There’s “wellness,” which includes a new category of functional superfoods marketed as though they have medication-grade power to give us stronger and better bodies. And there’s “clean label,” the increased insistence that packaged foods contain just a few familiar ingredients you might find in your pantry.

Perhaps most importantly, there’s the narrative that big food companies cannot save themselves, the idea that they must bring on outside help if they are to survive. By acquiring natural and organic food startups—helmed by mostly young, mostly college-educated, mostly white co-founders—multinational food conglomerates can buy their way to success and offset the flagging sales of aging marqee brands. The food industry is too old, too set in its ways, to change. But maybe it can be a benevolent master to the next generation of food companies, who are trying to offer America something new and truly different—or so the story goes.

Perhaps most importantly, there’s the narrative that big food companies cannot save themselves, the idea that they must bring on outside help if they are to survive. By acquiring natural and organic food startups—helmed by mostly young, mostly college-educated, mostly white co-founders—multinational food conglomerates can buy their way to success and offset the flagging sales of aging marqee brands. The food industry is too old, too set in its ways, to change. But maybe it can be a benevolent master to the next generation of food companies, who are trying to offer America something new and truly different—or so the story goes.

That newness is what’s emphasized again and again, as food media tells Epic’s story. The takeaway is that Taylor and Forrest invented something no one else had ever thought of, and that General Mills never would have tried in a million years. “At the time, no protein bar of this kind existed,” wrote Inc.’s Tom Foster in a breathless profile published last month. “Forrest and Collins had hit on a powerful formula for new food brands. It was a novel product concept that fused two hot categories, protein bars and meat snacks like jerky. There was their mission for a larger purpose—sustainable sourcing—and, of course, the couple’s own compelling story. It all added up to exactly the kind of authenticity that legacy companies only wish they could create on their own.”

But there’s a problem with the insistence, central to Epic’s own marketing and repeated endlessly in the press, that Forrest and Collins invented something that didn’t exist before: It isn’t true.

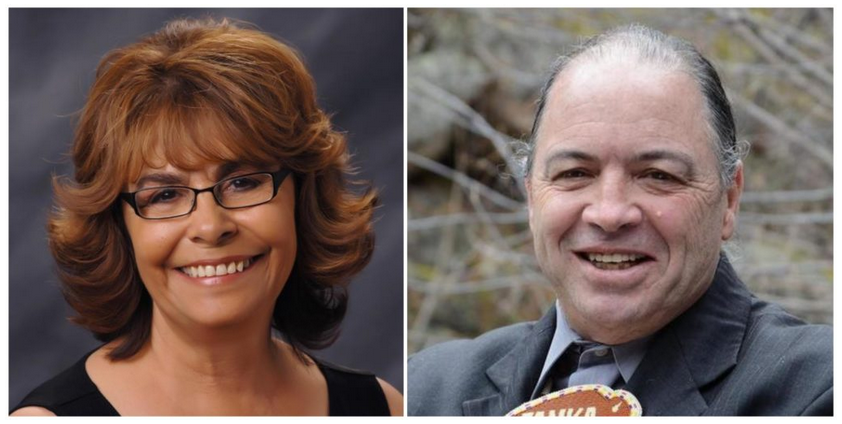

In 2006, almost a decade before General Mills acquired Epic, social entrepreneurs Mark Tilsen and Karlene Hunter started making the Tanka Bar, the first commercial meat and fruit bison bar, on the Pine Ridge Reservation in South Dakota. The goal was to create a product sourced from and produced by Native people who would help reduce the reservation’s unemployment rate, which hovers around 65 percent. The second goal was cultural. The co-founders hoped demand could be the economic driver that would restore the buffalo’s place in the lives of the Oglala Lakota people.

Tanka Bar

Tanka’s formula for its products is based on wasna (washNAH), a traditional meat and berry food eaten in the Great Plains for hundreds of years

Tanka may have been a community-minded enterprise, but it wasn’t a niche product. Sold in more than 6,500 retail locations across all 50 states, it’s been a bona fide commercial success in its own right. But Tanka’s role in popularizing the bison bar has been largely ignored by food media, and rarely mentioned in Epic’s glowing coverage. It matters because both companies, in their own ways, are making the claim that they better the world through food. But though the two products have superficial similarities, they couldn’t be more different. Their two divergent fates—an underdog struggling mightily to correct intractable social issues on its own terms, and a media-beloved startup trying to change a leading food multinational from within—do much to illuminate the challenges of making “good” food today.

While Tanka has had modest financial success, the company has sometimes struggled to attract funding and media attention, and its goal of making life better for a specific community has had both triumphs and setbacks. Epic, on the other hand, has been rewarded with admiring coverage and nearly bottomless investment—even though there are signs the company hasn’t lived up to the sweeping claims made in its marketing materials. Though Collins and Forrest insist they’re remaking America’s entire bison supply chain for the better—helping the planet and our bodies while they’re at it—the truth is more nuanced. Epic’s efforts have been viewed by producers and others in the bison business with, at best, mixed reviews. Questions about whether the company lives up to its promises are far from settled. And the broadly accepted narrative that Epic has been a force for good in the industry—and a transformational influence on its parent company—is worth revisiting.

In 2006, a group of Lakota bison producers approached Tilsen and Hunter for help. The duo had a successful record of establishing community projects on the Pine Ridge Reservation, a poverty-stricken place with rampant unemployment and attendant social ills like diabetes and suicide. With no background in the food business, the duo decided to develop a value-added product to give the producers a market for their meat: Tanka Bar, the first meat and fruit snack bar. “In our naivete we didn’t even realize we were disrupting an industry and were creating a new [retail] category,” says Tilsen.

Tanka Bar

Co-founders Karlene Hunter and Mark Tilsen didn’t expect the Tanka Bar to become a national sensation. When it did, they scrambled to borrow $1 million to ramp up supply to meet demand. “We were totally unprepared for real production,” Tilsen says.

The formula for their bars was based on wasna (washNAH), a traditional meat and berry food eaten in the Great Plains for hundreds of years. Tilsen calls it the first packaged meat because it was meant to travel long distances for months at a time without spoiling. Grandmothers still teach their daughters to make it by drying the meat and berries, adding buffalo fat, and pounding the mix together in a stone bowl, a key step that binds the acid in the berries with the proteins in the meat to prevent spoilage. When the people were nomadic, the resulting meat patties were sealed back in the bison stomach where they would provide sustenance through the lean season.

Making a modern version of wasna for commercial sale without the use of chemical preservatives was a high hurdle to overcome. But in late 2006, Tilsen met Jon Frohling, a fifth-generation South Dakota butcher and nationally recognized maker of award-winning preserved meats. Within hours, they had their first test batches going at Frohling’s plant. Tilsen credits Frohling with the success of their formula. “The truth is, the reason Tanka Bar is better than every other bar on the market is because of Jon,” he says. “While we didn’t have the expertise, we met these incredible people along the way who really loved what we were doing.”

While Frohling was developing the bars, Tilsen and Hunter undertook community outreach to create their brand. In Lakota society the buffalo is sacred, and the duo wanted to seek input on how their company might best exalt the bond between the animal and the Lakota Nation, while restoring the buffalo to the land, lives, and economy of the Lakota people. They surveyed almost 800 community members including youth, elders, and tribal leaders to learn the proper way to honor—and not exploit—the buffalo with their product. The result was a document they call their branding shield, and it spells out the values behind Native American Natural Foods (NANF), Tanka Bar’s parent company. To this day, every employee is expected to not only sign the document, but live by it.

It took about 10 months from the night those first batches went into the smoker to the launch of the bars at the 2007 Black Hills Powwow. Frohling packaged 10,000 small sample bars, which the company gave away to attendees. When the local TV weatherman opened one and ate it on air, Tanka Bar became a national sensation, ending up a few days later on the front page of The New York Times food section. “The story from The New York Times got picked up worldwide and literally melted our server to the ground,” says Tilsen. “We were totally unprepared for real production.” He and Hunter own a marketing company and so, unable to find an investor who understood what they were trying to do, they leveraged all of their assets and borrowed $1 million to ramp up production.

The company prospered in its early days, with sales growing by double digits every month. But then, as in most of America, business stalled with the Great Recession of 2008. Still, NANF persevered, and Tanka Bar sales eventually started to grow again. But after 30 quarters of strong growth, the competition changed. Other small meat companies popped up and tried to compete, but they lacked the production values and the back story that made Tanka Bar so popular. Then, multinational corporations started jumping into the meat snack space. In 2015, Hershey acquired Krave, a California jerky company, for more than $300 million. A year later, General Mills bought Epic Provisions, maker of the Epic Bar, for a reported $100 million.

After Tanka Bars took off, imitators soon followed. Clockwise from top left: Caveman’s meat bar, Wild Zora’s meat bar, a meat bar from a brand called Meatbar, Krave’s meat bar, and Epic’s meat bar

Though a global recession couldn’t stop Tanka’s growth, a flood of new imitators did. By 2017, the company was turning to the public for financial support, raising $125,000 from the equity crowdfunding site Wefunder.

“I really misunderstood who my competition was,” says Tilsen. “I thought I was competing against other little meat companies who were trying to figure it out. I’m still surprised by the magnitude of that capital.”

While Tilsen and Hunter were building Tanka Bar into a national brand, two young entrepreneurs in Austin, Texas were creating vegan protein bars for endurance athletes. Taylor Collins and Katie Forrest were tired of fueling their athletic endeavors with the traditional soy-based, sugar-laden protein gels and bars, and instead started experimenting with whole plant foods. Their Thunderbird Energetica line of bars launched in 2011 with an assortment of flavors that included fruit and nuts while eschewing GMO ingredients, wheat, soy, dairy or refined sugars. The bars were a hit, and in 2012 the pair scored a local producer loan from Whole Foods to expand the business.

But when Forrest started suffering unexplained knee pain, the pair decided to kick veganism and try a Paleo diet. “Within a few months, Katie and I were stronger, faster, and leaner than we had ever been,” Collins would write, later, on his company’s website. In 2013, they debuted the Epic bar, an offering with striking similarities to Tanka’s hit product. The main ingredients? Grass-fed bison and cranberry, like a spin on traditional wasna.

Cameron Smith, an angel investor, fell in love with the idea—and with a $750,000 infusion, Epic Provisions became a stand-alone company. With the subsequent help of an Austin business accelerator and a $3 million investment led by the Boulder Brands Fund, Epic Provisions expanded its product offerings from the original bison bar to include other meat, fruit, and nut bars, as well as bone broth and tallow. But the grass-fed bison bar has always remained at the center of its marketing efforts.

Cameron Smith, an angel investor, fell in love with the idea—and with a $750,000 infusion, Epic Provisions became a stand-alone company. With the subsequent help of an Austin business accelerator and a $3 million investment led by the Boulder Brands Fund, Epic Provisions expanded its product offerings from the original bison bar to include other meat, fruit, and nut bars, as well as bone broth and tallow. But the grass-fed bison bar has always remained at the center of its marketing efforts.

Epic Bars have been a big hit with the clean-eating Paleo crowd, and that’s no accident. The company’s explicit pitch to customers is that Epic provides a way to “eat like our ancestors ate.” Its website is littered with references to evolutionary biology, indigenous cultures, and hunter-gatherer lifestyles, suggesting that to bite into an Epic bar is to perform a kind of time travel—going back to an era before modern processing technologies distanced us from the sources of our food. Each bar features an illustration of the animal that supplies the main ingredient—grass-fed bison, grass-fed cattle, wild-caught salmon, wild boar—rendered as if by a 19th-century naturalist painter. The company slogan is “Live wild, eat wild.” It calls its office staff and customer base its “tribe.”

But though Epic’s brand relies on a nostalgic vision of stone-age eating, its purported mission goes far beyond that. The company’s reason for being, according to its marketing, is to change American animal agriculture over to pasture-based systems. Over and over again in its marketing and on its blog, Epic has spelled out in exacting detail its commitment to a nose-to-tail, whole animal model where little is wasted, along with its efforts to scale the grass-fed bison supply chain, bringing new bison ranchers into the grass-fed fold. This goal of providing financial support for ranchers who want to get into the business of pastured meat is central. As Collins put it in a 2016 blog post, Epic’s model means “grow[ing] supply chains of grass fed bison by financially incentivizing ranchers to do the ‘right thing.’”

But that’s where things get complicated.

Epic Provisions

General Mills bought Epic pledging to build the grass-fed bison supply chain, quickly reneged on its promise, and left a generation of suppliers in the lurch. Above, Epic supplier Lee Graese (second from left) with his family at Northstar Bison’s ranch

After General Mills acquired Epic Provisions, many in the natural foods world questioned whether a company trying to spread the gospel of grassbased, minimally processed proteins could partner successfully with a multinational conglomerate specializing in grain-heavy snack foods. Still, a year after the sale, Epic reported that things were going well. “We still operate EPIC independently at our World Headquarters in Austin, TX, wear flip flops to anything important, curse like ranchers, and seize any opportunity to be outdoors,” Collins wrote, in a blog post commemorating the acquisition’s one-year anniversary. To hear him tell it, selling out hadn’t changed Epic, it had only increased the company’s positive impact.

“From the beginning, it was our intention to utilize all the best parts of General Mills to accelerate our mission of large-scale grassland restoration and to create supply chains of pastured, grass-fed, and antibiotic free animals,” Collins wrote. “With General Mills adding muscle to the brand, EPIC accomplished over 10x the impact we could have accomplished independently…. Within the last year EPIC has sourced over 250,000 pounds of regenerative protein, [impacting] millions of acres of grasslands.”

But it’s not clear that Epic’s impact has in fact been a net positive, and the company’s efforts have been divisive in the bison community. Many producers and others in the business were hesitant to talk on the record about Epic for this story, citing their relationships with Collins and Forrest, or their fear that their businesses and the grass-fed bison niche in general could suffer if they aired criticisms in the press.

Still, the main point of contention—the 2,000-pound animal in the room—is clear. General Mills bought Epic pledging to build the grass-fed bison supply chain, quickly reneged on its promise, and left a generation of suppliers in the lurch.

When Epic decided to source grass-fed bison for its original bars, it hit up against serious supply chain limitations. As a result, the company had to supplement its grass-fed supply with grain-fed bison; those bars are labeled “natural,” rather than “grass-fed.” Epic still has not overcome that supply bottleneck. Collins says that, today, about half the bars are labeled “grass-fed,” an improvement from past years when only 10 percent of the bars were grass-fed.

When Epic decided to source grass-fed bison for its original bars, it hit up against serious supply chain limitations. As a result, the company had to supplement its grass-fed supply with grain-fed bison; those bars are labeled “natural,” rather than “grass-fed.” Epic still has not overcome that supply bottleneck. Collins says that, today, about half the bars are labeled “grass-fed,” an improvement from past years when only 10 percent of the bars were grass-fed.

Collins and Forrest hoped that General Mills would be able to help them build their grass-fed bison supply chain. At first, it seemed like their ambitious regenerative model would come to fruition. General Mills committed $3 million to a program to buy grass-fed bison in partnership with Northstar Bison, a family-owned operation based in Cameron, Wisconsin. The plan was that Northstar would buy the bison and contract with other graziers to feed them on grass until they were ready for harvest in three years.

“We were up front with them from the beginning,” says Lee Graese, the founder and owner of Northstar. “We told them it was going to be very expensive because of the cost of infrastructure, land, and animals.”

That’s where the culture clash seems to have started. General Mills owns brands that primarily produce processed, grain-based products—cereals, baking products, snack bars—and frozen fruits and vegetables. The company’s buyers are used to driving hard deals with distributors for the best prices on massive amounts of grain and produce over a single growing season. But meat, especially pasture-raised meat, works on a very different timetable. Everyone I talked with felt that General Mills didn’t understand bison or how to build a meat supply chain. (No one from General Mills would comment for this story.)

Epic Bar

Epic currently cannot source enough grass-fed bison for its bars. As a result, the company has turned to grain-fed bison for some of its bars. Those bars are labeled “natural,” rather than “grass-fed”

Graese says General Mills’ buyers expected that any cost savings would be passed along to General Mills. When it became obvious there wouldn’t be any savings, the company canceled what was supposed to be a five-year program after just a few months. Collins says that initial batch of 1,200 animals, now close to harvest, will end up costing Epic more than it would have spent buying meat wholesale.

Northstar still has a contract for 2019 with General Mills, but at a lower negotiated price. Graese says the company asked him how low he could go, and he gave them a price, “but I told them they don’t get the regenerative story with it.” Many of the small graziers and other businesses that jumped at the chance to be a part of the Epic bar story, and scaled up to handle the demand, are now suffering because the anticipated business didn’t materialize.

“We took the leap and went all in, but the rug got pulled out from under us,” one producer, who asked not to be identified by name, told me. “We really did bet the farm. We still need money coming in to run the place.”

With the supply of grass-fed bison stretched so thin, what, exactly is going into Epic’s bars? While the company claims to “use over 80% of the cattle and bison we source,” the suggestion that Epic is buying whole carcasses appears not to be true. On the bison side, the company is buying trim, a blend of the meat and fat left after the more salable parts like steaks and roasts are fabricated. At Northstar—a company Epic has cited extensively in its marketing materials as a kind of archetypal supplier—the high-end cuts remain with the ranch, which sells them independently. “That’s our end of the deal where we make the profit,” says Graese. Only the trim is sold to Epic. The company claims it’s using 80 percent of the animal, when it’s really buying only what’s left over after the more desirable cuts are parceled out.

Collins says Epic also uses bones and fat in its bone broth and tallow. But it doesn’t buy whole carcasses or offal, as would be the norm in a true whole animal, nose-to-tail operation—despite using the term “whole animal” prominently in its marketing.

Collins says Epic also uses bones and fat in its bone broth and tallow. But it doesn’t buy whole carcasses or offal, as would be the norm in a true whole animal, nose-to-tail operation—despite using the term “whole animal” prominently in its marketing.

You might think that buying trim would help bison ranchers somewhat. But even that marginal effort has been made in a way that doesn’t reinvest in the supply chain.

Currently, Collins says, much of the trim Epic buys comes from culls—mature cows at the end of their reproductive life—or animals from ranches where herd sizes need to be reduced because of drought or other management issues. While there’s a benefit to not wasting old or unwanted animals, especially when the end result is a processed meat bar, relying on culls isn’t building a sustainable supply chain or regenerating the land, as Epic purportedly wants to do. It’s economically unfeasible to invest in the enormous amount of land needed to raise bison entirely on grass, the fencing and other infrastructure necessary to keep the animals safe and healthy, and the cost of building a herd, without a buyer willing to pay for prime animals rather than culls. For most new bison ranchers, the numbers don’t add up.

Many of the other marketing claims Epic makes are also aspirational, rather than real. Collins says the company is excited that first-generation bison ranchers are joining the business. “We oversaw the first generation of people who want to get into ranching. It’s exciting to see fresh blood. We’re demystifying ranching, making it cool and desirable again,” he tells me. But he cites only two of those ranches. One is ROAM Ranch in Texas, purchased by Collins and Forrest after the General Mills buyout. The other, Wisconsin-based Grand View Bison Ranch, left the Epic program when the General Mills deal fell apart.

Where does that leave Epic and grass-fed bison? Almost everyone I spoke with agreed that the increased consumer awareness of bison as a protein option has been a positive for the bison business. But, to a person, they all felt that Epic got too big too fast without understanding how to build a sustainable grass-fed bison supply chain. That’s because, in order for the economics to work, the capital investment has to be a long-term one, and buyers have to be willing to pay more for grass-fed bison.

So far, General Mills and Epic have not managed to do either.

As the influx of corporate money rushed into the meat bar business, Tanka suffered. Tilsen says he’s had to lay people off in the past couple of years, which is especially painful. “When you lay off folks in a community like this, it isn’t like there’s another job. It almost feels like it’s taking their dreams,” he says.

Still, as a mission-driven company, NANF is taking the long view and refocusing. Tilsen and Hunter established the Tanka Fund, a nonprofit that provides grants for infrastructure projects for producers, as well as Tanka Resilient Agriculture, a producer co-op that will offer Native ranchers guaranteed contracts so more of them will be able to transition to raising grass-fed bison with sustainable, wild pasture management standards, the original regenerative agriculture. Right now, Tanka Bars don’t carry a grass-fed label because, while Native ranchers don’t feed grain, the company also sources from non-Native producers who do. The goal is to eventually have a 100-percent Native supply chain.

Tanka Bar

Imitators backed by big food companies have hurt Tanka’s bottom line, which in turn has forced the company to lay off some employees. Tilsen says: “When you lay off folks in a community like this, it isn’t like there’s another job. It almost feels like it’s taking their dreams.”

While capital has been hard to come by, Tanka Bar has been successful in other ways. The Tanka Fund has provided money for fencing and solar wells and helped a producer build a small slaughter plant on the reservation. In one example, a geological formation called Buffalo Ridge in Minnesota had become home to wind generators, but the Tanka Fund was able to bring animals back to the land, supporting one of its ranchers to open up springs on the ridge and construct fencing.

“That allowed us to put buffalo on top of Buffalo Ridge for the first time in 150 years. And the day they opened the gate and the buffalo went up there, in all honesty, the buffalo danced on the grass,” says Tilsen. “It made you think, ‘We’re doing the right thing.’ All the bureaucratic stuff and all the stuff we do, this is what success smells like. Just the buffalo back on the grass where they came from.”

While Tilsen admits NANF isn’t an attractive takeover or acquisition target, he believes success will continue. “I’m not that naïve to believe we’re going to return to a buffalo-based economy. But I am idealistic enough to believe that we can recreate a regenerative economy,” he says. “There’s no reason for 40,000 people on 2.9 million acres, living in a protein factory, to be protein starved and have the second highest diabetes rate in the country because they have no food system.”