JBS Can’t Escape Brazil Bond-Market Meltdown After BNDES Probe — Imagine the impact on the global food system if JBS went out of business …

JBS Can’t Escape Brazil Bond-Market Meltdown After BNDES Probe

December 13, 2015 — 7:00 PM MST Updated on December 14, 2015 — 8:09 AM MST

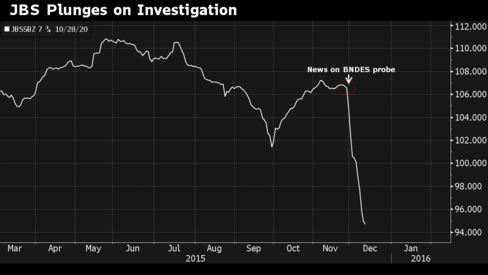

After dodging a rout in Brazilian bonds for much of the year, JBS SA has become a full-fledged participant in the selloff.

The world’s largest meat producer has seen its $1 billion of notes due in 2020 plunge 11 percent to a record low since Nov. 25, when Brazil’s federal audit court said it found evidence the company received “special treatment” in capital injections from state-run development bank BNDES. JBS’s debt had returned 10.3 percent this year before the announcement. The return was the highest in Brazil’s corporate-bond market, which has been roiled by a graft scandal, recession and political crisis.

With the court saying it will broaden its investigation into the transactions, investors are concerned the Sao Paulo-based company will face penalties that could reduce profits and harm its credit ratings. As part of BNDES’s policy of supporting Brazilian multinationals it calls “national champions,” the bank has bought almost 6 billion reais ($1.5 billion) of JBS shares since 2007.

“It is worrisome,” Omar Zeolla, an analyst at Oppenheimer & Co., said from New York. “The company could be required to compensate the bank.”

The audit court, known as TCU, said in e-mailed documents on Nov. 25 that it found evidence BNDES lost 847.7 million reais in transactions to help JBS purchase companies in the U.S. The bank allegedly overpaid for the company’s shares and gave up a premium payment when JBS acquired Swift & Co. in 2007, the beef unit of Smithfield Foods Inc. in 2008 and Pilgrim’s Pride in 2009, the court said in the documents.

JBS said the bond declines have been in line with other high-yield securities in the U.S. and Latin America in past few weeks.

"All transactions with BNDES were conducted in a clear and transparent way," JBS’s press office said in an e-mailed statement. "Details on each of the transactions between BNDES and JBS can be found in the company’s publications on its website."

In a statement Nov. 26, Rio de Janeiro-based BNDES denied wrongdoing and said its investments in JBS have been profitable.

The investigation into BNDES’s transactions with JBS isn’t related to a widening probe into corruption at Petroleo Brasileiro SA, the state-controlled oil producer, which has helped pushed corporate-bond losses in Brazil to 12.7 percent this year.

JBS may face penalties including fines and a temporary ban on financial transactions with state-run institutions, according to Jose Nantala Freire, a lawyer at Peixoto & Cury Advogados.

“The investigation is still in the early stages,” he said from Sao Paulo. “Consequences can be huge” if the court finds evidence of misconduct by JBS executives.

JBS had managed to sidestep the slump in Brazilian bonds this year by generating record profits and slashing its leverage to an eight-year low. The company gets more than 80 percent of its sales in dollars, which has left the meat producer flush with cash as the real suffers the biggest collapse among emerging-market currencies. The real fell 0.6 percent Monday to 3.8941 per dollar as of 10:09 a.m. in New York, leaving it down 32 percent this year.

“The fundamentals are not bad, but headline risk remains latent,” said Eduardo Ordonez, a money manager in Copenhagen at BI Asset Management, which oversees $1 billion of emerging-market corporate bonds. “Investors in Brazilian corporates have already taken several hits this year. You get the impression you are not safe anywhere, and the slightest hint of something odd happening is prompting people to pull out.”