Tariff-cover price gouging! : Greedflation Is Back as Corporations Use the Tariff Excuse to Hike Prices

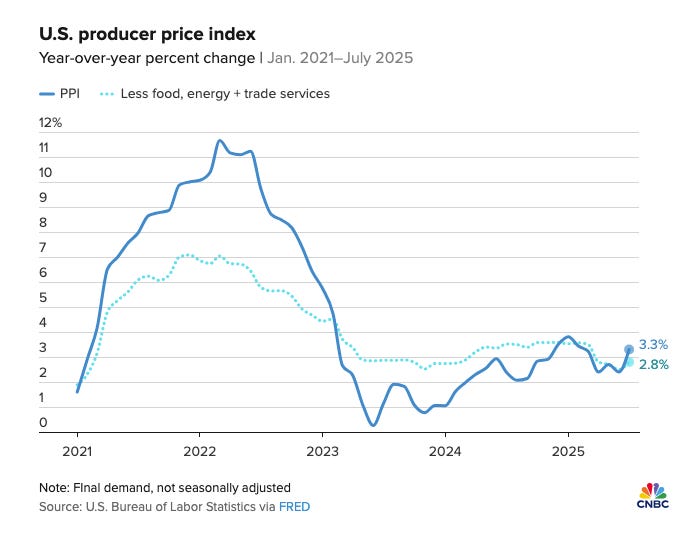

Greedflation Is Back as Corporations Use the Tariff Excuse to Hike PricesThe producer price index had bad higher-than-expected numbers today. But much of the increase was due to higher profit margins. And why wouldn’t it show that? That’s what Trump wants.Matt Stoller Aug 14 There’s been a lot of heat over the prospect of inflation and joblessness in our economy, so much so that Trump fired the head of the Bureau of Labor Statistics over allegations she was slanting the statistics to make him look bad. And the data is all over the place. So what I have come to trust is the polling and online chatter about what voters actually think about the cost of living and the economy. On Sunday, I noted that TikTok is full of videos of parents complaining about price increases around back-to-school season, even though pricing indexes don’t show much. It turns out that those parents were on to something, as price hikes are starting to show up in the official statistics. Every month, the BLS releases something called the Producer Price Index (PPI), which shows what domestic firms receive for what they make. It’s closely watched on Wall Street as a leading indicator of inflation, though it’s not as significant as the Consumer Price Index (CPI), which shows what consumers pay for stuff. Today, the PPI showed much higher inflation than expected, at 0.9% in July, the highest it’s been since the white hot days of 2022. For context, last month it didn’t increase at all, so this jump is a shock. Over the last 12 months year-over-year it’s a 3.3% increase.

Now 3.3% doesn’t seem that bad. But if you take July and just annualize that rate, it comes out to about 11% a year. I’m not an economic forecaster, so let’s do a bunch of caveats. It’s one month. It’s producer prices, not consumer prices. It doesn’t necessarily cover everything in the economy. Some of the numbers, like a massive increase for portfolio management services, don’t really matter. And while the PPI does match what consumers are saying to pollsters about the cost of living, the PPI doesn’t show consumer prices, but producer prices. So maybe this data point is a one-off and doesn’t matter. Still, I found one aspect of the PPI intriguing. Most reporters are blaming higher producer prices on tariffs, since that’s the narrative out there. Here, for instance, is the Financial Times.

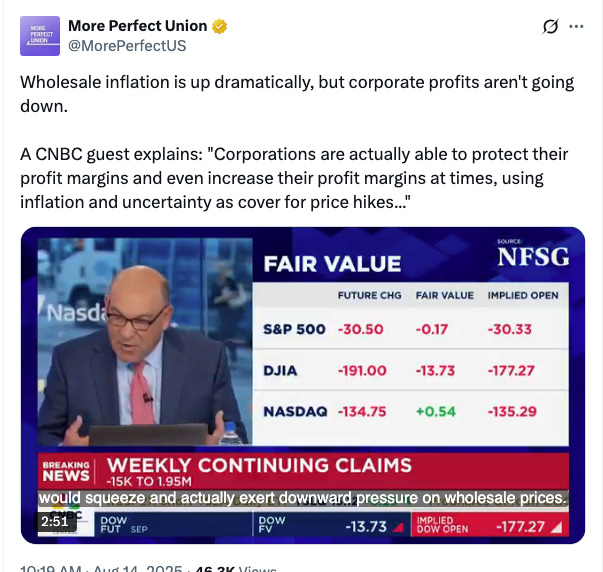

But according to the BLS, more of the hike is coming from services, which increased by 1.1%, versus goods, which went up by a still significant 0.7%. And going deeper into the numbers shows something even more interesting. The biggest contributor to higher services prices seems to be… profit margins. The term for margins in the PPI is called “trade services,” and the BLS says over half the increase in service costs “is attributable to margins for final demand trade services, which jumped 2.0 percent.” (Trade services isn’t identical to margins, and leaves out certain costs, but it’s the closest we have in the PPI to estimating profit growth.) I watched CNBC anchors this morning, and they were utterly befuddled that corporate margins could be going up, as they assumed corporations would be eating the tariffs by lowering profits. Jim Cramer even called for getting rid of the government agency that does the numbers and hiring Palantir and ServiceNow to do it on a privatized basis. And that’s because the story in the numbers is not helpful to the superrich or to Trump. It turns out, if the PPI data is accurate, that while there is a small amount of increase driven by tariffs, far more is driven by corporate use of the narrative of tariffs to raise prices and profits.

I was also intrigued by another nugget in the PPI, which is that the spike in the cost of goods is a result of a 1.4% increase in the cost of food. Fresh and dry vegetables jumped 38.9% in the month, eggs went up by 7.3%, beef and veal increased by 4.6%. Now those are really big numbers for a single month. Food is not considered part of “core” inflation by economists, but it is by those of us who need to eat. Now, one might ask the question, why are corporations raising prices so quickly to juice their profits? One simple answer is because they can. I mean, why wouldn’t you do that? It happened under Biden, and led to fantastic results for corporate America. But another reason is that’s what President Donald Trump seems to want. And that gets to another little-noticed action this administration took just before the PPI release. In 2021, Joe Biden issued an executive order saying the government must promote competition across all agencies, which most farm groups and consumer groups praised, and the U.S. Chamber of Commerce panned as a “government knows best approach.” It included things like addressing ag consolidation, repealing non-competes, more antitrust enforcement, and using the Robinson-Patman Act to help small grocers and producers. It also represented political support for the antitrust cases against RealPage, Apple, Ticketmaster, Google, etc. Yesterday, Trump did what the U.S. Chamber of Commerce sought, and revoked that executive order. Then, Trump’s antitrust enforcers, Gail Slater and Andrew Ferguson, both released statements praising the repeal of the order. It wasn’t quite asserting that the policy of the Trump administration is simply to promote monopolies, but it was close. There are reasons to imagine some of the big tech suits could go forward, but fundamentally, having companies acquiring and exploiting market power to foster higher stock prices would be consistent with Trump’s goal of making the stock market go up.

Assistant Attorney General of the Antitrust Division Gail Slater regularly bashes her predecessors. And that is a change from Trump’s initial framework in April, on “Liberation Day,” in which he sought to force companies to eat the cost of tariffs, and didn’t seem to care about the stock market. Here’s Andrew Ferguson, at that moment, promising fierceness on exploiting market power.

But that moment never turned into anything. After financial markets revolted, Trump pulled back significantly on tariffs for China, and that was the ostensible core of his strategy. Since then, when Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick took over, the stock market and cryptocurrencies have gone on to record highs, Congress passed a tax cut for financial capital, and Trump signed into law a bill to deregulate finance. Populism is over. It’s unsurprising that his antitrust enforcers have followed along. Today, the Antitrust Division has no merger cases pending, which is a significant turnaround from the Biden era. Similarly, the Federal Trade Commission hasn’t moved forward with a single conduct case. Agency staff numbers are dwindling, and I’m not sure Slater or Ferguson could even bring meaningful new monopolization complaints if they wanted to. Ferguson has been reduced to embarrassing and trivial anti-woke political meddling, such as encouraging truck makers to emit more pollution. It’s possible the PPI numbers are a one-off, or wrong. There are significant problems with government statistics, as they don’t reflect what voters are telling pollsters they are seeing. So maybe none of these numbers matter. Ferguson, Slater, and Trump better hope that’s the case, because they increasingly lack the tools to quell profit-driven inflation. That dynamic cost Biden his Presidency and it cost the Democratic Party its credibility. Liberals looked like this, and their reputation hasn’t recovered.

|