Reorg Research: US Cattle Group Explores Legal Action Against JBS, Alleges Antitrust Wrongdoing

The Ranchers-Cattlemen Action Legal Fund (R-Calf USA), which represents U.S. cattle growers, is talking to attorneys to explore ways in which it can litigate against JBS to address wrongdoing related to anti-trust activities that the company is allegedly involved in, the CEO of the group told Reorg Research.

Bill Bullard said the group is talking to law firms and monitoring how similar legal disputes being launched in the poultry industry play out before taking more concrete steps. Bullard said the fact that companies in the “highly concentrated meatpacking industry” in the US not only own meatpacking plants but also poultry distribution and breeding facilities as well as pork processing businesses means that similar legal issues in the poultry industry can shape how potential antitrust litigation plays out in the cattle industry.

“They play one protein off against another. What is going on in the poultry industry will have an influence on the cattle industry. We are talking to attorneys, we are looking at how we can address widespread antitrust issues,” Bullard told Reorg.

R-Calf USA is monitoring ongoing legal cases against JBS-owned poultry producer Pilgrim’s Pride, including a lawsuit by poultry grower M&M Poultry -which started litigation against Pilgrim’s in 2015 after it claimed the company breached its contract.

Pilgrim’s is in the business of breeding, processing, packing, producing, selling and distributing poultry, and enters into poultry growing agreements with farmers.

M&M alleges that under a poultry grower agreement Pilgrim’s wrongfully placed M&M in competition with other growers “while requiring [it] to accept chicks that are genetically different, and chicks in varying degrees of health” to ensure Pilgrim’s “ability to wrongfully control its cost of operations at the expense of its growers.”

R-Calf USA is also monitoring the outcome of a class action lawsuit launched in 2016 by Maplevale Farms against a group of companies including Pilgrim’s, claiming the firms “conspired and combined to fix, raise, maintain, and stabilize the price” of poultry.

The U.S. cattle growers group sent a letter to officials in the country including the White House the Department of Justice, and the Senate Committee on the Judiciary in June requesting investigation and antitrust enforcement actions against JBS, citing the recent Brazilian corruption scandal as a basis for the actions, as reported by Reorg. At least one entity, the US DoJ, acknowledged receipt Bullard told Reorg, but R-Calf USA did not have any information about an investigation being launched against JBS.

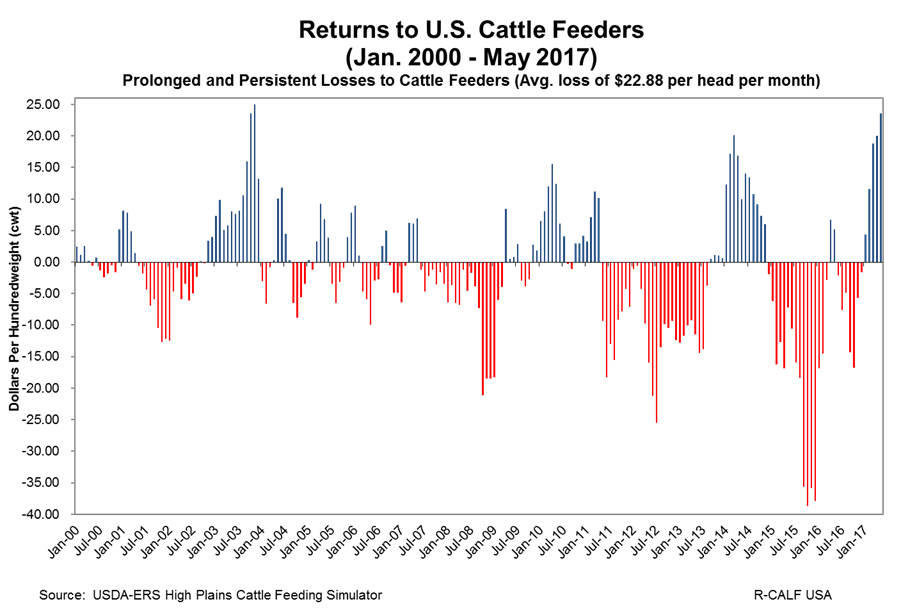

R-Calf USA claim that, since the acquisition of Five Rivers Cattle Feeding in 2008, the Brazilian meatpacker has been manipulating the price of cattle, halting price rallies by increasing slaughters, and then coming back to the market to fulfil supply needs. R-Calf USA also alleges that JBS was timing imports from Mexico and Canada in order to reduce or drive down cattle prices, Bullard said.

The string of U.S. companies acquired by JBS in the past 10 years has also raised questions from R-Calf USA about the nature of sanctions from U.S. authorities.

“The public policy influenced by JBS raises the spectre of unlawful activity in the US,” Bullard said. “We need to get to the bottom of how this company was so successful in persuading congress to meet its needs.”

He added: “JBS is the second largest meatpacker and the largest poultry packer in the US. It is a huge company that is important to the food security of this nation. The importance of getting to the bottom of this is critical.”

Bullard mentioned the planned acquisition of National Beef Packing by JBS, which was blocked by regulators, as an example of the actions U.S. authorities are able to take agains the Brazilian meatpacker.

“Unfortunately, JBS is at the threshold, if not beyond being too big to fail. Because it controls about 24% of all of the fed cattle in the US, there is a concern if they are unable to pay for their cattle, that could have a huge impact on our US market,” Bullard said.

In an emailed statement in response to a request for comment from Reorg, a JBS spokesperson said: “In the U.S., the livestock purchase and sale markets are highly regulated by the federal government of that country. JBS USA is the second largest meat producer in the country, actively participating in these markets, contributing to the official benchmark of animal prices and offering farmers the opportunity to sell their livestock at competitive prices using a variety of innovative marketing programs.”