New Food Economy: Restaurants to eaters: Please, for the love of god, stop using Seamless

When Teddy Roland took the big step of expanding beyond his taco truck to a six-stool restaurant in Bedford Stuyvesant, Brooklyn, in late 2014, it was clear that he needed to encourage delivery business. So he not only put a menu and ordering page on his website, he started signing up for a handful of services that collect orders and deliver restaurant food to customers, sites like Seamless and DoorDash and UberEats.

Two years later, he’s having second thoughts. He was fed up with having a half dozen tablet computers from online ordering companies in his shop, all beeping and ringing as orders came in. “My little family shop started looking like a Sprint store,” he says. Worse, his delivery partners typically took a cut of 20 percent or more.

We are going to start the revolution against these huge companies, located thousands of miles away, who rob small businesses and customers of their hard-earned dollars.

When Roland decided to do the logical thing—raise prices on orders placed through third-party services—two of the companies he was considering, Postmates and DoorDash, insisted that delivery prices match his in-house prices.

“How is that different from the Mafia in the 70s saying, ‘I’m going to take 200 bucks not to break your legs?’” he says. “‘We’re going to take 20 percent of your money and you have to live with 80 percent.’

“That’s complete bullying.”

To fight back, he’s been slipping notes inside his sandwich shop’s delivery orders, asking customers to stop using Seamless and GrubHub and to use the restaurant’s own website instead.

“We are going to start the revolution against these huge companies, located thousands of miles away, who rob small businesses and customers of their hard-earned dollars,” the note reads.

“Revolution” may be too strong a word for it, but there’s no doubt that many small restaurateurs like Roland are pitted against the new paradigm of online ordering and delivery. Whether you see Roland as a David fighting Goliath, a Don Quixote, or even as a Marie Kondo pushing out techno-clutter, he illustrates the challenge restaurant owners face navigating the myriad options for delivering their food. Going it alone, however, may be a tough if not impossible task, given a competitive marketplace, the accelerating pace of technological change, and intransigent human nature.

Two for you, one for me

The economic theory of third-party restaurant delivery is pretty straightforward. They’re platforms that aggregate an area’s restaurants, process online orders, and manage credit card transactions. The two most familiar “delivery” companies, Seamless and its parent, Grubhub, don’t actually deliver anything at all: restaurants still have to run the food themselves. Other platforms use private delivery fleets, sparing restaurants the hassle and expense. These services charge some combination of fees and commissions and, if all goes well, the restaurant makes up in volume what it loses in margins.

Seamless will shut you down.

According to GrubHub, restaurants using its service see their monthly takeout revenue grow by an average of 30 percent, and one in five restaurants double their takeout revenue one year after signing onto GrubHub.

Since GrubHub launched in Chicago in 2004, the model has exploded: its competitors now include Yelp’s Eat24, Caviar, UberEats, Munch Ado, DoorDash, delivery.com, Postmates, Olo, Homer, and ChowNow, to name just the best known. The specifics vary, with some of the companies focusing on particular parts of the order/delivery process, while others are broader in their approach, combining marketing and logistics. Mostly, companies like Seamless are a consumer convenience play. They’re virtual food courts where hungry customers can scroll local listings and settle on something tasty for dinner, then place an order with a few quick clicks. As more and more food is ordered online, takeout joints live or die by their prominence on those well-curated lists.

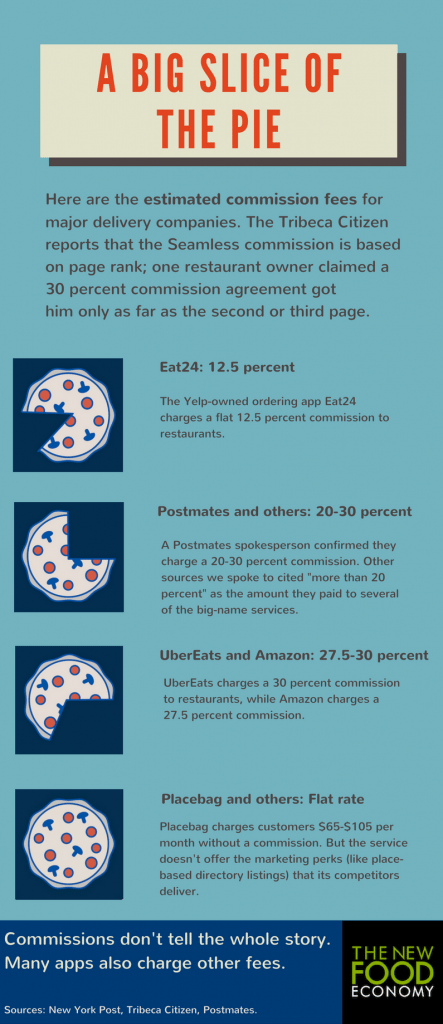

But streamlined ordering tends to be a major expense for restaurants, with delivery companies taking commissions of up to 30 percent, experts say. Eat24, a mobile app and online ordering platform, charges a 12.5 percent commission, according to a spokeswoman. Postmates, a two-year-old New York courier service that also partners with participating restaurants, charges a commission on orders ranging from 20 to 30 percent and customers pay a fee of $2.99 or $3.99 depending on the city, says April Conyers, Postmates’ director of communications.

Other companies add flat fees per order, charged to the restaurant or the customer, and some charge processing fees, transaction fees or placement fees for listings on their website. Like several other delivery companies, Postmates insists on price parity between in-store and online menus, she says. “We don’t want customers to be paying more for goods than if they actually go to a place,” she says. “We don’t allow marked-up menus on the platform.”

“It’s like a love-hate relationship,” says Adam Price, who says Homer, the delivery system he started two years ago, constantly sees restaurants trying to break away from third-party delivery platforms.

“They all hate it, but they need it,” he says.

Homer fashions itself as a replacement for a restaurant running its own delivery fleet, which can be expensive and inefficient, Price says.

“With Seamless and the big guys charging large percentages of each order, that takes a nice big cut out of the bottom line obviously,” says Mark Engel, business development manager for Placebag, which designs online ordering systems for restaurants. “That’s just a big incentive to move away from those guys.”

Placebag charges $65 a month for a restaurant to place an online ordering system on its website and social media such as Facebook, while a monthly fee of $105 connects those orders to the restaurant’s own point-of-service software, Engel says.

“I wouldn’t tell restaurants or customers to totally leave [companies like Seamless and GrubHub],” he adds, saying Seamless can bring in new customers such as tourists.

If every restaurant in the area agreed to participate in a No Seamless/GrubHub week, coupled with a joint marketing campaign to the community residents and businesses, what would happen?

“But as far as the actual customer that goes to them anyway and orders from them anyway, why give away 15 percent of each order? It doesn’t make any sense.”

While Roland doesn’t hesitate to air his complaints, it’s hard to find others who are so outspoken, largely because urging customers to use a different ordering system violates Seamless’s contract terms, Price says.

“Seamless will shut you down,” he says.

When asked about this, a representative of Seamless said it does not require exclusivity from its restaurant partners.

“Every owner-operator is trying to siphon their consumer base out of Seamless into a more profitable channel because Seamless has such a high take rate, but nobody will tell you or be very vocal about how they’re doing it,” Price says.

It just seems like there’s a land grab in the delivery area.

Of course, not everyone wants out. “I’ve not heard of any revolt. We really like it,” says Timothy Swanger, manager of Rare Bar & Grill, at Hilton New York Fashion District. “From my standpoint as a restaurant manager and really thinking of service first, I think it’s a great thing.”

In an article on Tribeca Citizen, 15 local restaurant owners were interviewed, and none was willing to be publicly identified as they complained about the costs, technology, and service of GrubHub and Seamless.

Several readers, commenting online, suggested restaurants band together and add incentives for customers to order from their own websites.

“I wonder what the appetite is for a coalition of local restaurant owners against Seamless,” one wrote. “If every restaurant in the area agreed to participate in a No Seamless/GrubHub week, coupled with a joint marketing campaign to the community residents and businesses, what would happen?”

Joe Fassler Endless Summer will offer a Seamless alternative—customers can order directly from its website

After the gold rush

The question may be moot. Experts expect to see a shakeout in delivery, which may well change costs and policies. And Amazon, a serial disruptor, is venturing into the market as well.

“It just seems like there’s a land grab in the delivery area,” says industry analyst Bob Goldin of Technomic.

Anytime you think about ordering food, you just think about Seamless.

“I think you’re just going to see, at the end of the day, it’s pretty hard to differentiate,” he added. “The customer doesn’t care.” Price predicts companies that focus on a single area, such as the merchant aggregators like Seamless that market and process orders, and those on the back end handling delivery logistics, will fare best. “I believe what’s going to happen is what’s happened in every other industry, that there is explicit value in specialization,” Price says. “Specialize in one thing and do that one thing really well.”

Less promising are the more unwieldy, broader efforts to market, process orders and fulfill deliveries such as Postmates and DoorDash, he says.

Bloomberg reported recently that Square Inc. tried to sell Caviar, its food delivery business, but was turned down by potential buyers like Uber, GrubHub, and Yelp. It said Caviar was losing money and pulled out of Atlanta, Minneapolis and Miami. It also reported that Postmates had been slow to raise new financing and, earlier this year, the financing efforts of DoorDash fell short.

Stock in GrubHub, meanwhile, has seen a healthy rise. Its price has risen to $42.64 from $30.68 in late October of 2015.

Seamless has succeeded at training customers to think of its website first, says Price. “Anytime you think about ordering food, you just think about Seamless,” he says.

A convenient truth

Going without a system like Seamless, which Roland hopes to do one day, means coaxing customers to give up the convenience. Swanger thinks that may be difficult right now.

“Let’s face it. New Yorkers are all about convenience,” he says. “Unless he gets 10,000 restaurants to follow his suit, you’re really not going to take on Seamless or GrubHub, I don’t think.”

Identified only as Mike, a delivery restaurant owner in Brooklyn commented on the Tribeca Citizen piece that he had stopped fighting Seamless, which he called a “necessary evil” with a “greedy business model.”

“It is next to impossible to get people to stop using Seamless and order through your site,” he wrote. “People want everything in one spot, and Seamless does that for ordering.”

Roland says he would dearly love to see his customers willing to make the extra effort to go to his website and sign in with a name and password to place orders.

He is raising his Seamless and GrubHub prices to encourage them, and he is offering customer loyalty programs such as a free 11th order as well as lower prices on his website, he says.

“I’m asking a little more out of my customers,” he says. “You want to be lazy and just use your thumbprint and GrubHub app, you’re going to pay more for it, that’s all,” he says. “If you log into my website and put your password, you’ll get a cheaper sandwich and the 11th one will be free.”

“Come on,” he says. “Get with the program. I’m trying to hook you up.”