Iowa Farmer Today: Farms exceed Chapter 12 bankruptcy debt

FYI.

Good morning. Solid data from reputable sources in the public domain relative to the number of farmers and ranchers in financial trouble is a bit difficult to come by, so I am sharing today’s article below. Based on the high level of stress and the number of calls to the Nebraska Rural Response Hotline, the level of financial stress in the country continues to rise as the status of ag loan renewals becomes more clear. The three years in a row of below the cost of production ag commodity prices for many ag producers, plus the lack of positive market and farm income prospects for 2017 are taking their toll on the Nebraska families that farm and ranch.

All the best,

John K. Hansen, President

Nebraska Farmers Union

1305 Plum Street, Lincoln, NE 68502

402-476-8815 Office 402-476-8859 Fax

402-476-8608 Home 402-580-8815 Cell

john

Farms exceed Chapter 12 bankruptcy debt

· By Bill Tiedje, Iowa Farmer Today

May 1, 2017

· IFT graph by Bill Tiedje

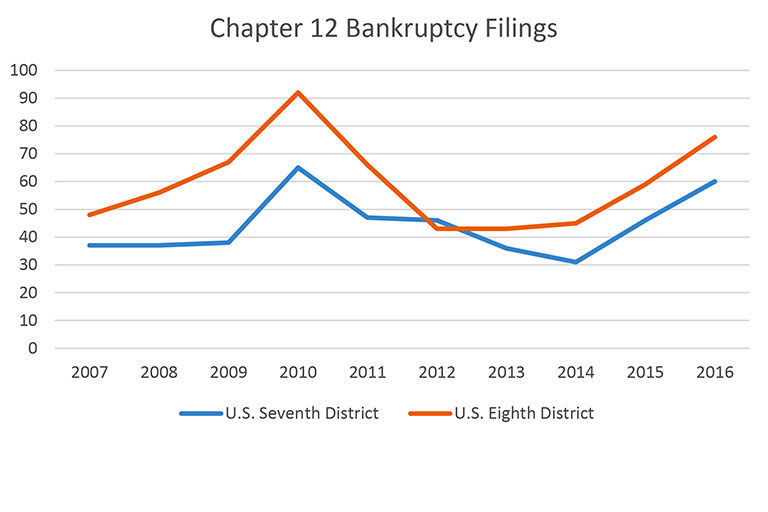

The graph shows the number of Chapter 12 bankruptcy filings in the U.S. Seventh and Eighth Districts. The Seventh District includes Illinois, Indiana and Wisconsin. The Eighth District includes Arkansas, Iowa, Minnesota, Missouri, Nebraska, North Dakota and South Dakota. Data courtesy uscourts.gov.

While farming has changed in many ways since the 1980s, many aspects of agricultural bankruptcy are similar today. Some question whether the provisions have kept pace with the growth of modern agriculture.

Joseph Peiffer, who has practiced bankruptcy law in Cedar Rapids, Iowa, since 1985, said well more than half of the farmers coming into his office during the past two years did not qualify for a Chapter 12 bankruptcy because they had aggregate debts in excess of the current inflation-adjusted limit of $4,153,150.

The debt limit for Chapter 12 bankruptcy became tied to inflation in 2005. Before that, the limit was $1.5 million.

“The debt of family farmers has increased far faster than the rate of inflation,” Peiffer said. “That’s why the debt limit, I believe, is too small. I’ve been advocating to (increase the aggregate debt limit to) $10 million.”

Peiffer said nearly half of his clients who don’t qualify for the current debt limit would still not qualify with a $10 million limit.

Chapter 12 bankruptcy is intended to allow “family farmers” to propose and carry out a plan to repay all or part of their debts.

To qualify for Chapter 12, in addition to being engaged in farming, at least 50 percent of a family farmer’s total fixed debts (excluding debt from the home) must be related to farming, and 50 percent of the gross income for the individual or husband and wife must come from farming.

Family farms organized in partnerships or corporations may also file if they meet additional qualifications.

Many farm operations today consisting of a husband, wife and a kid or two could be over the limit, Peiffer said.

Barry Barash, who also specializes in agricultural bankruptcies in Galesburg, Ill., explained modern farmers often need to spread narrow profit margins across thousands of acres to make a living.

As banks and landlords begin to “tighten up,” Barash said, “breakeven at best” conditions lead to difficulties.

“It’s a very, very tough row,” he said.

Peiffer said for farms with debts in excess of the limit for Chapter 12, he is left without his “most powerful tool.” Farms in default may also file for bankruptcy under Chapter 11 or Chapter 7, a liquidation bankruptcy.

Compared to Chapter 11, Chapter 12 filings may have tax and interest rate advantages for farmers downsizing their operation and gives creditors less control in approving a repayment plan, Barash explained.

Due to the complexities of agricultural bankruptcy, Barash said it is important to work with a skilled practitioner, familiar with agriculture.

“You have to know the ins and outs,” he said. “In order for any of these plans to work, they have to be feasible.”

Barash said there are “an awful lot of farmers who have ‘red and green disease.’” Buying equipment to reduce taxes is “no big deal” if you’re paying with cash, but if you’re borrowing money for the purchase, you need to decide if that is a good use of resources, Peiffer said.

Peiffer said current conditions require farming to be viewed strictly as a business, with every decision viewed under a microscope.

“We have to look at it as a business and not just a way of life,” Peiffer said. “Is it going to make me money or not?”