In the Cattle Markets: Feedlot profitability — Record setting disaster!

In the Cattle Markets: Feedlot profitability

By Glynn Tonsor, Kansas State University December 01, 2015 | 8:07 am EST

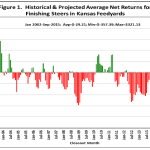

Last week Dr. Brooks broke down the most recent USDA Cattle on Feed report noting how estimates overall were in line with pre-release expectations. Given the lack of surprises in this report, it is useful to re-examine the most recent estimates of closeouts offered in K-State’s Kansas Feedlot Net Return series to extend understanding of the current situation faced by feedlots. This report, which provides both historical and projected return information, released on November 11th indicates steers sold in September at a loss of $357/hd.

This is the largest estimated loss in the K-State series history (Figure 1). It is further important to note that just one year ago this same series was presenting record profits (in $/hd levels). This extreme shift clearly conveys the highly volatile nature of feedlot returns. It is further critical to appreciate the K-State series mimics a cash market situation without price risk management strategies being implemented. Those operation regularly implementing price risk mitigation tools likely experienced moderated positive returns in 2014 and losses to-date in 2015 would likewise have been diluted in most cases. While many feedlots indeed engage in price risk management, few can fully offset price risks as it is rare that attractive margins can be “fully locked in” at placement leaving most feedlots at least partially exposed to price risks upon placement.

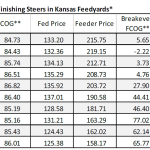

Projections for closeouts over the next 9 months remain negative reflecting stable cost of gain estimates in the presence of feeder cattle priced “too high” relative to projected fed cattle sales prices (Table 1). The best month projected is May 2016 steer closeouts (-$46/hd) where feeder cattle purchases are estimated at $163/cwt which is substantially lower than the $219/cwt estimated for placements scheduled for November 2015 closeouts. The extreme losses projected for November (-$499/steer) would by far be the worst experienced. The main implication of this situation is that feedlot operators, lenders, and analysts would be well-served to monitor profitability even closer than normal. Given the well documented long-term concerns with excess capacity (too much feedlot bunk space relative to calf crop size) and more recent situation of elevated sale weights, the level of these adverse margins is likely to pressure additional feedlots to adjust practice and in some cases cease operations entirely.

The Markets

The 5-area live fed cattle price for the week was up at $126.34/cwt. Feeder cattle reporting was limited due to Thanksgiving. Corn prices were up trading at $3.60/bu in Omaha.

COMMENTS:

To not acknowledge the effects of imports continues to be the problem with our land grant universities.. Foreign impact into our market should be addressed. USA has a market that no other can claim. Our "great" beef checkoff scam has failed "miserably again". Reduction in price to producers has not been reflected in retail beef prices. Importing packers are the cause and we feel the effect. Where is your supply and demand "theories"? I am betting you provide services to the NCBA cronies! Remember this that if producers are profitable they can cure most of their own problems and we do not need to be the "lowest cost producer on the face of the earth". Have you ever thought about retirement? Mike S.