Great Falls Tribune – Are the big meatpackers corrupt? Growing consensus in Congress

Are the big meatpackers corrupt? Growing consensus in Congress

Great Falls Tribune

A different decade, a new administration, a shuffle in Congressional leadership. Much has changed across the U.S. political landscape in the last several years, yet one concerning issue has lingered for nearly half a century … corporate concentration within the meatpacking industry.

"The time has come for the government to determine whether the stranglehold large meatpackers have over the beef processing market violate our antitrust laws and principles of fair competition," states a recent congressional letter to U.S. Attorney General Merrick Garland. "… four large meat packing companies control over 80% of the processing market in today’s economy and are seemingly able to control prices at their will, or even defy expectations of market fundamentals.

"From our perspective, the anti-competitive practices occurring in the industry today are unambiguous and either our antitrust laws are not being enforced or they are not capable of addressing the apparent oligopoly that so plainly exists. This needs to change."

The letter was signed by 28 members of Congress including both Montana senators Jon Tester and Steve Daines. Support for confronting anti-competitive practices in the meat packing industry spans political ideologies, with arch conservative Representative Paul Gosar’s (R-Ariz.) signature appearing alongside that of ardent liberal Representative, Ro Khanna’s (D-Calif.).

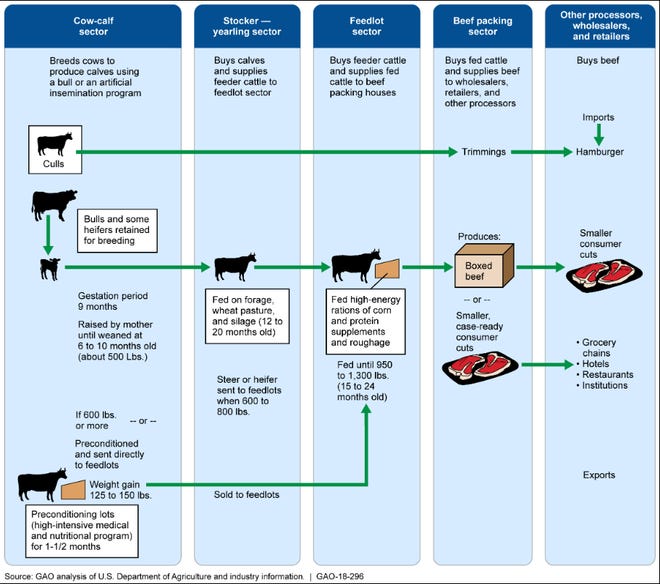

Concentration within the U.S. meatpacking industry has been a significant concern for more than 30 years. According to USDA statistics, the number of cow/calf operations in the U.S. has been cut nearly in half over the last 40 years, from 1.6 million in 1980 to fewer than 883,000 today. Fewer than 2,000 commercial feedlots now finish 87% of the cattle grown in the U.S. The largest of these can hold more than 400,000 animals at a time.

At the top of the meat production pyramid stand the international meatpacking corporations. Through the 1970s the U.S. meatpacking industry was diverse with multiple regional packers competing with a handful of large national corporations to buy finished livestock.

According to the U.S. Census Bureau in 1977 the nation’s four largest meatpackers processed a quarter of the cattle grown in the United States, and 84% of all steer and heifer slaughter occurred in plants processing less than half a million animals a year. By 1997, plants in that category saw their share drop to 20%, while 63% of meat processing occurred in plants that slaughtered more than a million steers and heifers annually.

Today the U.S. meatpacking industry is concentrated into four multinational corporations – JBS of Brazil; Arkansas-based Tyson Foods; Cargill Meat Solutions of Wichita; and National Beef, based in Kansas City, Mo., but owned by Marfrig Global Foods of Brazil. Together these four corporations control more than 80% of the nation’s meatpacking capacity. Add to that roughly a third of the U.S. beef supply is controlled by Brazilian corporate interests.

Critics of this industrial consolidation point to two recent events to demonstrate how it puts U.S. cattle producers at an unfair disadvantage.

On August 9, 2019, a fire at the Tyson packing plant in Holcomb, Kansas, temporarily shut down about 5% of the cattle industry’s processing capacity. Cattle bound for the Holcomb plant were detoured to plants in Iowa, Nebraska and other parts of the Midwest, but its net effect was to place downward pressure on the price of cattle futures traded on the Chicago Mercantile Exchange (CME).

Ranchers and feedlot owners were forced to accept deep discounts on the price they received for their animals, plus incurring increased transportation costs to get livestock to more distant processing facilities. However, the big packers Tyson, Cargill, JBS and National Beef saw their profit margins double in the weeks following the Tyson plant fire.

According to Sterling Beef Profit Tracker, packer margins jumped from $191 to $358 per head in the week following the Tyson plant fire, By August 23, 2019, packer margins reached a high of $490.88 per animal. In that same time period, feedlots lost an average of $20.50 per head.

Jump ahead seven months into the onset of the COVID-19 pandemic, and a similar pattern emerged.

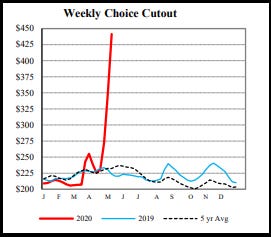

Leading into 2020 the price of cattle futures on the CME were sagging but relatively stable. According to an investigative report by the U.S. Department of Agriculture, prior to March 2020 the price of live steers was hovering at around $108 per hundredweight, meaning that a feedlot owner could reasonably expect to receive $1,200 for each finished steer delivered to a meatpacking plant.

When the full implications of COVID were realized in mid-March 2020 there was an immediate rush by consumers to stockpile beef, increasing retail demand by more than 30%. At the same time, widespread COVID infections among workers in the meatpacking industry led to a 36% decline in beef processing capacity.

The big four (Tyson, Cargill, JBS and National Beef) decreased their purchases of live cattle. Ranchers and feedlot owners saw the value of their herds drop by more than 18%. At the same time, the big meatpackers reported all-time record profits, with the spread between live cattle and boxed beef more than tripling from $66 per one hundred pounds in mid-March to over $279 per hundred pounds in mid-May.

Critics, including both Montana senators Jon Tester and Steve Daines, argue that the meatpacking industry has run amok, and is illegally colluding to reduce slaughter volumes and live cattle purchases to reduce price competition among themselves.

“The price of live cattle in the United States market has plummeted, while the price of boxed beef has significantly increased, raising consumer prices at the grocery store,” the letter to Attorney General Garland states. “The major packing companies realized significant profits, while both U.S. beef consumers and independent cattle producers paid the price. These large price disparities are leading independent cattle producers to go broke and causing consumers to pay an unnecessary, over-inflated premium on beef.”

Tester’s concerns extend beyond market manipulations to U.S. food security in general.

On June 2 the world’s largest meatpacking corporation, JBS, announced it had become the target of a ransomware cyberattack, with alleged Russian hackers getting into the company’s computer network and threatening to disrupt or delete files unless a multi-million dollar ransom was paid.

Within several days JBS reported "significant progress" in resolving the cyber-attack and said that it hoped the vast majority of its plants would be operational in the coming days. However, the company declined to share specific technical details with federal investigators on the nature of the attack. The FBI believes the cyberattack is attributable to hackers in Russia.

"I think it speaks to our vulnerabilities, absolutely," Tester told the Tribune of the JBS cyber attack. "It’s not only in meat. I think it’s also in inputs in agriculture for sure. These threats are real, and quite frankly they are intentional. It’s about raising problems in our economy. It applies to food, it applies to energy, it applies to water distribution, it applies to everything.

Although not authoritatively confirmed by JBS, the company reportedly paid several million in ransom to halt the threat.

"That’s not how you deal with this stuff," Tester said. "You give them money and they’ll be back again and they’ll want more. We’ve got to make sure that the prime companies are sharing information so we can get to the bottom of this."

The bottom may be more about money and political influence than the broader interests of ranchers and small businesses.

According to the Federal Elections Commission, the meatpacking and meat products industry contributed nearly $4 million in campaign contributions during the 2020 election cycle, with the top recipients, in order, being President Donald Trump, Presidential Candidate Joe Biden and Senate Majority Leader Mitch McConnell. The industry topped that off with nearly $4.2 million spent on Congressional lobbying efforts.

Tester’s proposal is to give the Department of Agriculture more authority to investigate and prosecute meatpackers who collude or use illegal price manipulations to control U.S. production.

"Talk has been cheap around this issue," he told the Tribune. "We need to get to the bottom of it. We need to figure out if there’s been price manipulation going on. We need to make sure that small meatpacking plants can sell meat across state lines to help reduce consolidation out there.

"I am working to give the Department of Ag a special investigator, and if we can get that passed it will give the Ag Department the ability to have subpoena power to enforce the Packers and Stockyards Act."

David Murray is Natural Resources/Agriculture reporter for the Great Falls Tribune. To contact him with comments or story ideas; email dmurray@greatfallstribune.com or call (406) 403-3257. To preserve quality, in-depth journalism in northcentral Montana subscribe to the Great Falls Tribune.