‘Throw me a bone here’: Small meat processors say USDA measures don’t address consolidated industry’s root problems

Burdened with relatively higher operating costs than the largest meat processors, small meatpacking plants are struggling to survive — even with $1 billion in federal grants available to them.

by John McCracken, Investigate Midwest November 30, 2023

Why you can trust Investigate Midwest

Over the past two decades, Greg Gunthorp carved out a niche operating a small meat processing plant in northern Indiana. He sold several kinds of meat to chic Chicago and Indianapolis restaurants and to Chicago O’Hare International Airport, he said. He also sold direct to consumers.

But selling in grocery stores was not an option, as the largest meatpackers often have those contracts. In his circumstances, he found it difficult to compete in the chicken industry, and he recently stopped raising and slaughtering the bird.

“In an extremely concentrated marketplace,” he said, “it’s difficult for a small processor — especially a plant that slaughters — to find a sweet spot somewhere to fit long term.”

In an industry in which four companies — Tyson Foods, JBS, Smithfield and Marfrig — control most of the meat market, small slaughterhouses are struggling to compete. The Biden administration has tried to address the concentration, including offering grants to help small processors expand. But it’s not enough for many small processors that face proportionately higher operating expenses than the industry giants, according to interviews with small processors and experts.

“I think we’re gonna see a lot of these plants go out of business or sell,” said Rebecca Thistlethwaite, the director of the Niche Meat Processor Assistance Network, which helps support small processors apply for federal grants and with marketing.

Sign up now!

Every Thursday you can receive a newsletter with a roundup or our latest investigations and stories.

When asked about the problems small processors identified, the U.S. Department of Agriculture responded that the $1 billion in grants it’s invested in expanding small processors “is a historic investment that will directly combat consolidation in the meat processing sector and help build resiliency in the face of market disruptions.”

Smaller plants that process fewer than a thousand animals a year can serve a region. But the largest meatpacking plants, the ones that process millions of animals a year and are owned by industry giants such as JBS and Tyson Foods, package the majority of meat that ends up in grocery store aisles across the country.

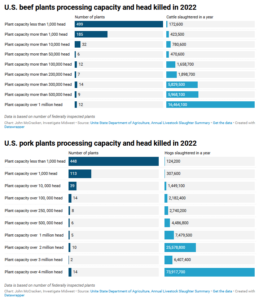

Just 12 federally inspected plants produced slightly less than half of the country’s beef supply in 2022, according to Investigate Midwest’s analysis of U.S. Department of Agriculture data. The same year, 14 plants produced about 60% of the nation’s pork.

Hundreds of small processors were responsible for less than 1% of the nation’s beef and pork supply. https://datawrapper.dwcdn.net/cnut9/1/ https://datawrapper.dwcdn.net/TgT9m/1/

Because of their size, the largest meatpacking companies can keep their expenses low, leading to more profits, experts said. The same economic rules don’t apply to small processors.

In the pork and poultry industries, large meatpacking plants often already own the pigs and chickens they slaughter, so there is no need to buy animals on an open marketplace. In the beef industry, cattle ranchers still often sell their product to slaughterhouses, but the sparse number of meatpacking plants in a given area lowers what plants are willing to pay.

Large meatpackers also have contracts with retailers, ensuring their product ends up at grocery stores, as opposed to farmers’ markets or meat counters, said Bill Bullard, the CEO of R-CALF USA, which advocates for independent cattle producers.

“They’ve exceeded any efficiencies associated with economies of scale and are now engaged in controlling the marketplace,” he said.

The North American Meat Institute, a lobbying organization for the meatpacking industry, disagreed with the premise that meatpacking giants make it harder for small ones to compete.

Large processors have experienced their own problems — drops in earnings and recent plant closures, such as the ones in Missouri and Indiana — and have little sway over the meat marketplaces, the organization said.

“If large packers could control price,” Sarah Little, the organization’s spokesperson, said in an email, “they are doing a bad job of it.”

The retail price of chicken hit a record high in early October, which should benefit Tyson Foods and other major poultry processors, according to Reuters. Meatpackers have also been dogged by accusations of price-fixing: Last year, the country’s largest food distributor accused the largest packers of suppressing supply in a case still pending. Around the same time, Smithfield Foods, a major pork processor, paid $42 million to settle price-fixing accusations.

For Gunthorp, to maintain business in the Chicago area, he has to focus on quality over quantity, he said. He has to market directly to consumers, through his website or at farmers’ markets. Without a contract to sell at grocery stores, he’s cut out of access to many consumers.

He said the USDA’s grant program to expand meat processing capacity can be helpful, but the federal government isn’t addressing core problems.

“It’s a complex problem to solve,” he said. “I don’t know that they delved into it hard enough.”

Biden administration efforts

The meatpacking industry’s concentration has far-reaching effects. During the COVID-19 pandemic, some plants were forced to close for days or weeks as workers fell ill or died. Animals must be delivered to plants as soon as they reach a certain weight, but the closures interrupted the supply chain. Some producers were forced to kill their animals en masse.

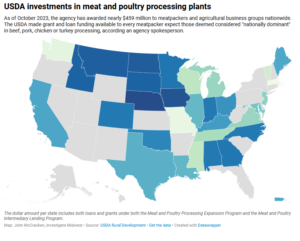

Responding to the supply chain issues, the Biden administration announced last year a $1 billion program to combat consolidation in the meatpacking and food sectors. Any processors outside of the industry giants were eligible for funding. Plants in Iowa, Nebraska and North Dakota — states with large beef and pork footprints — have received the most funding. About $450 million has been awarded overall as of October. https://datawrapper.dwcdn.net/nVpT1/3/

When he announced the program, President Joe Biden said, “We’ll give farmers and ranchers more options beyond giant processing conglomerates, and shore up the weak points in our food supply chain.”

The funding is a promising sign in addressing the industry’s concentration, said Peter Carstensen, a professor of law emeritus at the University of Wisconsin and an antitrust law expert. But the administration should also be using its antitrust enforcement capabilities more than it is, he said.

“There is a real challenge to get to a scale large enough to be able to compete,” Carstensen said. “It’s a real problem for the smallest slaughter operations.”

Serving a small community

The USDA’s grants have had a tangible impact on the White Earth Reservation in northern Minnesota, home to just under 10,000 people.

Much of the reservation, the largest in the state, is considered a food desert. Residents often travel more than 40 miles to shop for groceries.

Mike Callicrate, owner and founder, walks through the packaging plant at the Ranche Foods Direct in Colorado Springs, CO, Oct. 27, 2023. The beef is raised on the family farm Callicrate Cattle Co. in St. Francis, KS, and processed at the plant in Colorado Springs. photo by Christian Murdock for Investigate Midwest

The grant helped Paul Benson start construction on a meat processing plant on the reservation. Once up and running, it will be able to slaughter and pack about 30 beef cattle a week. It should be able to feed roughly 14,000 people a year.

The plant, expected to open in 2024, will feature a storefront and sell at local farmers’ markets. The project received nearly $1 million from the USDA’s Meat and Poultry expansion grant. Benson said he was thankful for the support from the USDA as it will help revitalize food options for his neighbors.

“We’re not feeding the world,” he said. “We’re feeding a very small community.”

Closing after fewer than 2 years in business

In west Texas, a small processor had the opposite experience.

After opening in summer 2021, Marfa Meats closed its doors in January, said owner Christy Miller. In this area of the state, one-third of the rural population travel at least 10 miles to the nearest grocery store, according to the USDA.

“It was a major hit on this community when we went away,” she said.

Miller applied for a USDA grant but was denied. In her proposal, which she shared with Investigate Midwest, she requested about $48,000 to help her expand production: She needed a larger freezer space, compost equipment and packaging materials.

The grant funding must be spent on projects or new equipment, but Miller said what would have been most helpful was if she had been able to to spend the money on general operating expenses, which isn’t allowed.

“I’m bringing in a million dollars a year and I’m still not able to close the gap,” she said. “If you want me to stay in business, throw me a bone here.”

Several challenges contributed to the plant’s closure, Miller said.

- The plant’s location: Marfa is in a remote area about 60 miles from the U.S-Mexico border.

- Upfront costs: She routinely paid more for cattle because it was more expensive for ranchers, she said. It makes more fiscal sense for cattle ranchers to sell thousands of animals to a large processor rather than offload small quantities to small-scale processors.

- Labor: Miller had a hard time finding people who knew how to slaughter and carve an animal. Large processing plants use an assembly line approach — they have hundreds if not thousands of workers each performing one task over and over again.

- Needing to charge premium prices: Because of the business’s costs, Miller had to sell at a higher price than what many local consumers were used to paying for in grocery stores, she said. Miller estimated that her prices were a couple of dollars more per pound than chain grocery stores for items like ground beef.

“You’re competing against the costs of these huge operations,” she said. “Your prices are always going to be high.”

The USDA grant would not have been a silver bullet even if she received it, she said. It would have given her breathing room, but the grants do not address root problems in the industry, she noted.

“What upsets me is all of the lip service that they’re giving to these grants,” Miller said. “I’m living proof that it’s not a sure thing by any means.”

HOW WE ANALYZED THE DATA

Investigate Midwest analyzed annual reports published by the USDA that provide the number of federally inspected pork and beef processing plants, the operational size for plants and how many animals they kill in a year. Percentage values were determined by comparing the number of animals each plant size slaughtered last year to the overall number of beef cattle or pigs processed in the country.

read more on meat industry consolidation

A consolidated market leaves ranchers wondering what’s next

Congress could beef up meatpacking oversight this fall. But obstacles to enforcement remain.

Pillen’s Rise: After building pork empire, Nebraska’s governor stands at intersection of state and ag power

Citations & References:

Interviews and Statements:

Christy Miller, Oct. 10, Oct. 25 and Oct. 30, 2023

Paul Benson, Oct. 10, 2023

Bill Bullard, Oct. 25, 2023

Rebecca Thistlethwaite, Oct. 25, 2023

Greg Gunthorp, Oct. 3, Oct. 10 and Oct. 25, 2023

USDA Statement, Oct. 27, 2023

Sarah Little, email, Oct. 23, 2023

White House, Remarks by President Biden During a Virtual Meeting to Discuss Boosting Competition and Reducing Prices in the Meat-Processing Industry, January 2022

Citations:

Investigative Midwest, A consolidated market leaves ranchers wondering what’s next

Investigative Midwest, Infected, Exhausted, Distressed

Politico, America’s meat supply is cheap and efficient. Covid-19 showed why that’s a problem.

Reuters, Smithfield Foods to pay $75 mln in pork price-fixing settlement

Reuters, Record chicken prices squeeze US shoppers, benefit Tyson Foods

Documents and Data:

USDA National Agricultural Statistics Service Livestock Slaughter Annual Summary 2022

USDA Rural Development data from fiscal year 2012 to 2023

Minnesota Department of Health, Food Access memo, 2019

USDA, Economic Research Service, Food Access Research Atlas

Complete article: https://investigatemidwest.org/2023/11/30/throw-me-a-bone-here-small-meat-processors-say-usda-measures-dont-address-consolidated-industrys-root-problems/