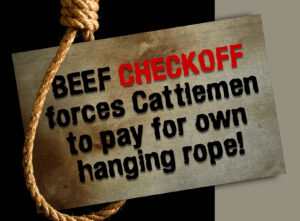

The NCBA is Worried that the Off Act will fix the Beef Checkoff

Op-Ed by Gilles Stockton, Montana Cattlemen’s Association Director

Take your pick. You are either “anti-agriculture,” a “radical animal rights activist,” or a member of a “fringe group,” if you believe that the beef checkoff tax should be transparent and accountable. This, at least, is the opinion of Colin Woodall, CEO of the National Cattlemen’s Beef Association (NCBA) in a recent op/ed – Senator Mike Lee’s OFF Act is an Attack on American Agriculture.

The Opportunities for Fairness in Farming Act (OFF Act) proposed by Senator Lee (R Utah) and Senator Cory Booker (D New Jersey) has Mr. Woodall and the NCBA in a state of apoplexy. This bill will require regular independent audits, and disallow checkoff programs from contracting with organizations that engage in political issues. You can understand why NCBA is upset as they have been caught with their hand in the cookie jar and regularly lobby against the interests of the ranchers and feeders who pay the checkoff tax.

Back in 2010, a very partial audit authorized by USDA looked at the equivalent of nine (9) days of checkoff disbursements and found that over $200,000 had been misappropriated. If you project that to a full year, this would be about $8.1 million or 31% of what the NCBA rakes in from the checkoff. Needless to say, this was too embarrassing, so USDA buried the audit. An attempt by the Organization for Competitive Markets (OCM) to have the details released has come to nothing. There have been no further audits.

One would think that regular independent audits would be required in the Beef Promotion and Research Act of 1985, but that is not the case. Also not included is a requirement for periodic referendums to determine if cattle producers continue to support the checkoff. Think about it. No rancher or feeder under the age of 58 has ever had an opportunity to vote for or against the checkoff tax.

The beef checkoff became a tax in 2005 when the Supreme Court upheld a lower court ruling that the checkoff program is “government speech.” The NCBA argued for this decision even though they continue to claim that the checkoff is “producer led.” The case was brought by a group of ranchers who marketed their own “branded” beef and felt that the “generic” promotion of beef by the checkoff worked against their business interests. It was, they felt, a matter of “freedom of speech and association.” They lost.

The NCBA keeps trotting out their “return on investment” study which claims that every $1.00 spent returns $13.41 in higher prices. You would think that this study would be based on market research but instead, the economist they hire, plugs a string of assumptions into a complex formula and – presto – a rabbit is pulled out of a hat. The author admitted in court that this $13.41 is a measure of the profits at the retail level, not what ranchers received for their calves.

Whether this final number is valid or not, what is not accounted is the negative effects on the market from NCBA’s lobbying. For instance, when Country of Origen labeling was rescinded in 2015, the price for 500 to 600 lbs. steers dropped from $253.30/cwt to $168.48/cwt. That was an overnight loss of $466.51 per head. Subtract from that the alleged $13.41 benefit from NCBA’s administration of the beef checkoff tax, and we had, thanks to the NCBA, a net loss of $453.10 on each steer.

There are two choices. You can shrug off the market losses caused by the NCBA’s pro-packer lobbying and continue paying the unaccountable beef checkoff tax. Or, you can support the OFF Act and accept that the NCBA will call you an “anti-agriculture activist.” Your Congressional delegation needs to hear from you.

Montana Cattlemen’s Association

Press Release

Release Date: June 16, 2025

Contact person: Gilles Stockton

(406) 428-2183

Email: mca@montanacattlemen.org