Pre-Debate Tariffs Myth Buster…

Note from Lori Wallach: One of the key points in the document is that across-the-board tariffs on all goods from all countries are most likely to increase retail prices – because a key factor that otherwise determines whether retail process are affected by tariffs is substitution of non-tariffed goods. If folks have not, please take a minute to read the document because there is a lot more than my highlights. We must be careful in our reactions to Trump not to generally attack a policy tool – tariffs – that can be very useful to achieve progressive economic, climate and social justice goals. When we call for “trade sanctions” against a country for human rights violations or for the enforcement of labor or environmental standards in trade agreements, we are calling for the use of tariffs.

And, with respect to the broader economic and competition questions, it is critical to note that the advent of easy and expansive capital and technology mobility upended much of past trade theory and undercuts the past research findings. The notion of comparative advantage relies on countries have certain “natural” attributes that favor them specializing in certain areas of production. But the ability of billions in foreign investment to chase the lowest wages and environmental/labor standards with the click of a mouse and the 1990s on neoliberal “trade” agreements that protect free investment flows (and with ISDS subsidize investment/job offshoring) and also limit non-tariff regulatory standards must have Adam Smith and David Ricardo rolling in their graves given this Mont Pelerin Society nightmare of protecting markets from democracy has been branded as “free trade.”

With massive subsidies, forced labor and a ban on independent unions and mass environmental “dumping”, China has built “absolute advantage” and overwhelming production monopolies in numerous sectors. In the era of hyperglobalization, targeted tariffs use is essential to create fair market conditions to allow for investment, tax, procurement and other industrial policy tools to develop competing domestic production capacity here – as well as what other government are doing with tariff defense and industrial policy offense in other parts of the world. This is critical to restoring competition… and to build resilience, a fairer economy and enhanced security. As COVID supply chain collapse and resulting shortages and corporate price gouging that remains active to this day revealed, it is perilous to have production of most categories of critical goods centralized in too few locations whether it is China or elsewhere.

——————–

Given the political hubbub on tariffs, their uses, and their effects—and the frequent repetition of misinformation—I wanted to share some facts and citations in one short document. Some of the myths debunked include:

· Contrary to the branding campaign by importers and economists, tariffs are not, um, Satan’s spawn, or even weird. Tariffs are a bipartisan tool used for decades here and by many nations to develop industries vital to economic and national security and as a defense against unfair imports that would otherwise fill domestic demand, deprive producers of a fair market, and chill investment in new capacity and/or crush domestic production.

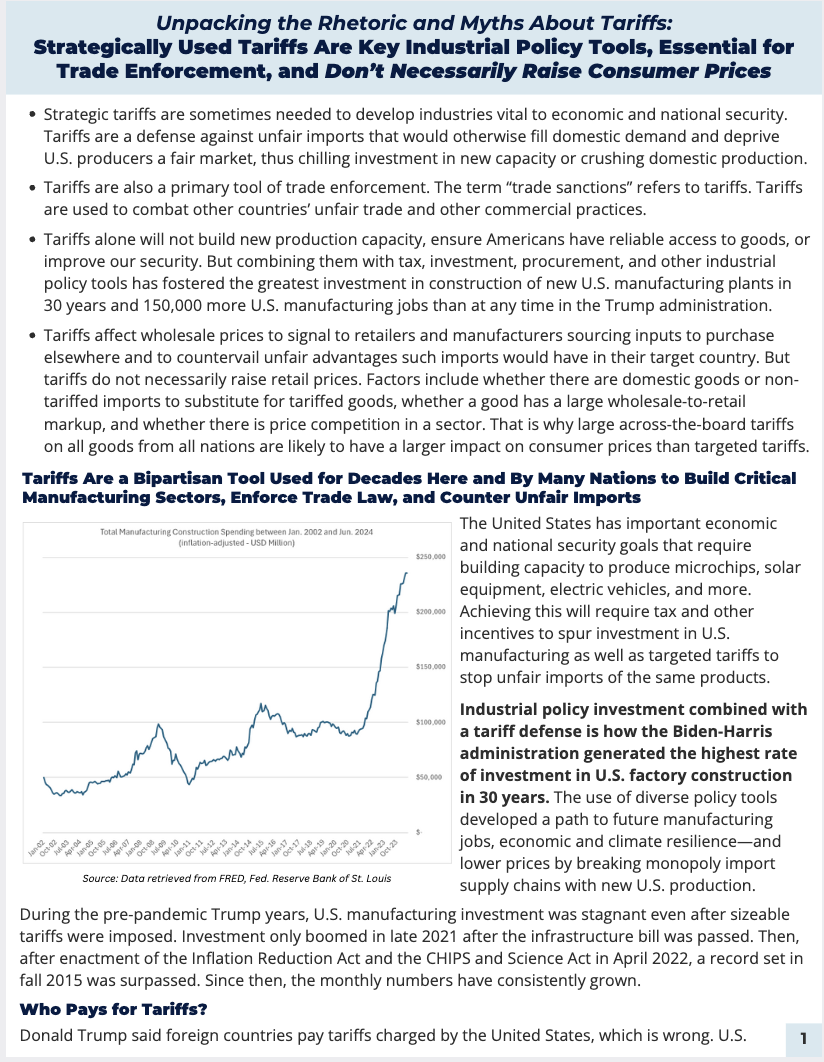

· Combining tariffs with tax, investment, procurement, and other industrial policy tools, the Biden-Harris administration has fostered the greatest investment in construction of new U.S. manufacturing plants in 30 years and 150,000 more U.S. manufacturing jobs than at any time in the Trump administration.

· Tariffs do not automatically raise retail prices! The most comprehensive NBER study of the price effect of Trump’s 2018-19 China tariff increases show U.S. retailers absorbed the tariff cost by reducing profit margins.

- This study also debunks the tariffs-increased-washing-machines-retail-prices example so many stories cite. The researchers found retail prices also increased in Canada where there were no tariffs for the same washer brands and types, suggesting something other than U.S. tariffs was at play.

· Whether the intended increases in wholesale prices caused by tariffs are passed through to a retail price depends on many factors, including availability of domestic goods or non-tariffed imports to substitute for tariffed goods and whether there is a large wholesale-to-retail mark up and/or price competition in a sector. That is why large across-the-board tariffs on all goods from all nations are likely to have a larger impact on consumer prices than targeted tariffs.

· Foreign countries do NOT pay for U.S. tariffs. U.S. consumers do not pay for tariffs. Firms that choose to import goods that are subject to tariffs pay. The funds go to the U.S. treasury.

· Studies that conclude the cost of U.S. tariffs “were borne domestically” is another way of saying that the exporter did not lower wholesale prices to compensate for the tariff but rather the U.S. importers paid the additional tariff cost. This is a totally different finding than that U.S. consumers paid for tariff costs.

Lori Wallach

Director, Rethink Trade at American Economic Liberties Project

lwallach || Twitter @WallachLori || www.RethinkTrade.org