AgWeb: Two of the Four Major Meatpackers Grilled Over Competition During Senate Hearing — Some things never change…

“The North American Meat Institute (NAMI), which represents the meatpacking industry, also submitted testimony to the hearing, saying when it comes to talk about concentration in the industry, “the four-firm packer concentration ratio for fed cattle slaughter has not changed appreciably in more than 25 years.””

True, “the four-firm packer concentration” hasn’t changed in 25 years. Since the late 1970’s, the big three have been managing, concentrating, and consolidating the market with tools like cooperation, designation of territories and not-to-buy bids, mentally conditioning feeders to take lower prices by manipulating the futures markets, price depressing captive supplies, sweetheart deals, and false propaganda campaigns like, “It’s supply and it’s demand,” orchestrated by NCBA, Cattle Fax, NAMI, USDA, and university professors.

Perdue University professor, Jayson Lusk, has replaced touts like Kansas State University professors Ted Schroeder, Jim Mintert (now Perdue), and Colorado State University professor, Stephen Koontz, in making the false claims of efficiency and economies of scale, and advocating that cattle producers should be more like chicken farming serfs.

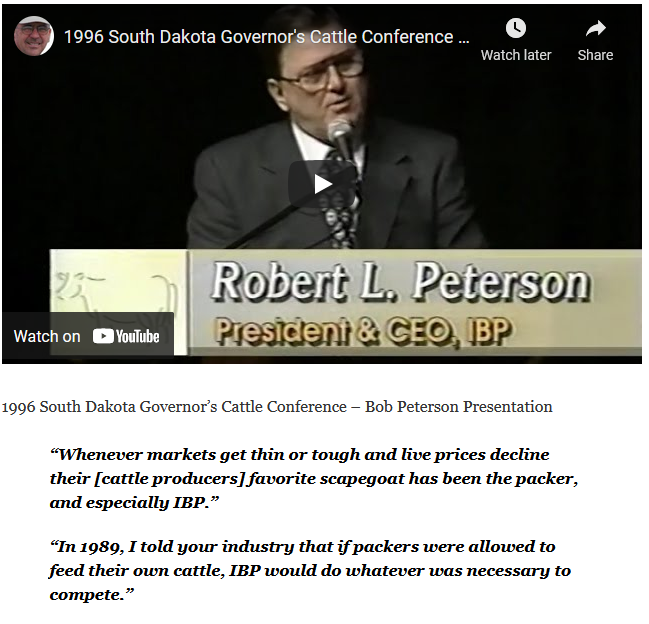

The video from 25 years ago tells the story: https://nobull.mikecallicrate.com/2021/07/09/1996-south-dakota-governors-cattle-conference-fails-to-prevent-industry-decline/

Howdy Farmers Union Members and Friends,

I was proud of the clarity, quality and depth of the testimony of NFU President Rob Larew. He and our NFU team done us proud.

Based on my 45 years of fighting for more competition in cattle markets, I know that it is now or never time for the cattle industry. Chickens are gone. Swine is mostly gone. Cattle is hanging on by their fingernails. If you care, now is the time to give ag market reform one more fight. The stars are aligning in our direction. President Biden’s Executive Order, the ag groups coming together, the bipartisan support for market reform, these are really good signs. Dig deep. This issue is who we are, and this is our issue. Let’s go for it.

All the best,

John K. Hansen, President

Nebraska Farmers Union

John Office

Jhansen3 Home

(402) 476-8815 Office (402) 580-8815 Cell

(402) 476-8608 Home (402) 476-8859 Fax

1305 Plum Street, Lincoln, NE 68502

AgWeb

Two of the Four Major Meatpackers Grilled Over Competition During Senate Hearing

AgDay 07/29/21 – Senate Judiciary Cattle Market Hearing

By AGDAY TV July 28, 2021

Competition in the meat sector was on center stage in Washington, D.C. Wednesday. The same day the House Agriculture Committee tackled the topic of the state of the beef industry and beef supply chain issues during a hearing, the Senate Judiciary Committee put the meatpacking industry in the hot seat on Capitol Hill.

Wednesday’s Senate Judiciary hearing, called “Beefing up Competition: Examining America’s Food Supply Chain,” follows a hearing last month in front of the Senate Ag Committee. At that time, leaders got input from cattle producers and industry groups about the supply chain, and concerns about lack of transparency, but no one from the meat packing sector took part.

Wednesday’s hearing included witnesses representing producers, meat packers and grocers. The list included:

· Jon Schaben, Iowa Cattlemen’s Association, owner of Dunlap Livestock Auction

· Rob Larew, president of the National Farmers Union

· Shane Miller, president of fresh meats at Tyson Foods Group

· Tim Schellpeper, president of USA fed beef at JBS USA

· David Smith, president and CEO of the Associated Wholesalers Grocers

· George Slover, Consumer Reports senior policy council.

The hearing marked the first time any of the four major meatpacking companies – which include JBS, Tyson, Cargill and National Beef – had a chance to defend their practices on Capitol Hill this year. But that didn’t stop Senators and others from grilling the meatpacking representatives from JBS USA and Tyson Foods Group who joined the hearing virtually.

Grassley Presses Tyson Foods

“Mr. Miller, Iowa cattle producers tell me that during the first week of May this year Tyson wasn’t buying cattle from independent producers,” said Sen. Chuck Grassley (R-Iowa), Ranking Member of the Senate Judiciary Committee. “With so few players in the market, that gives producers limited options. Noted in Mr. Schaben’s testimony and according to data from the National Daily Cattle and Beef Summary reported by USDA Agricultural Marketing Service, on May 10th of this year, the choice boxed beef cutout was valued at more than $309 per hundredweight. At the same time, cattle producers struggled to break even… How do you justify making such low bids when you’re turning a significant profit?”

“We depend on independent cattle operations of all sizes, and we can’t do without all of them,” said Shane Miller of Tyson Foods. “I don’t know the specific date you referenced in May, what we were doing in the marketplace that day versus another day, but what we pay Iowa cattle feeders truly depends on the market conditions. But how they end up deciding to sell their cattle whether they want to negotiate or put them on an AMA, is totally up to them.”

Grassley Questions Cash Trade

Grassley also made clear his concerns about what he says are big companies that wield much of the control in the livestock processing industry, as he says the amount of cattle traded on the cash market in the early 2000’s was more than 50%, but today that number has dropped to 20%.

“Are independent producers who negotiate, offered the same opportunities to market their cattle as larger corporate feedlots do through formula contracts? And would you be opposed to having the base price premiums and any discounts shared with the public,” Grassley asked during the hearing.

“We are active in the cash market every single day at JBS,” said Tim Schellpeper, of JBS USA. “In fact in the state of Iowa, we have several buyers that are headquartered there. Again, active participants, are they offered the same price? Yes, they are on a cash basis, on a day in day out basis.”

Other Senators also pressed the packers during the hearing, but asked questions pertaining to anti-competitive claims of groups like the National Farmers Union (NFU).

“How about breaking up some of these some of these Packers,” asked Sen. Josh Hawley, (R-Mo.)

“Look, we are all for shining a light having a review and if necessary, break them up,” said Rob Larew, president of National Farmers Union (NFU).

“Something is seriously wrong here and it cannot go on as it currently is. And I for one think it’s time to take that kind of action. You were talking about it Mr. Larew, I think we need antitrust enforcement. And I think we as a committee have got to look forward to some policy suggestions to change the balance,” Hawley concluded.

Larew also highlighted why what NFU sees as competition problems in the cattle sector are trickling down to cattle producers.

“While there are some important differences between the structure of the industries that produce cattle, hogs, and poultry, farmers and ranchers raising these livestock all face a shared challenge: slaughter and processing sectors that are more concentrated today than they were several decades ago, said Larew. “These industries are also more vertically integrated, eroding farmers’ control over their livelihoods. Furthermore, farmers and ranchers face thinning or nonexistent cash markets, which can hamper price discovery and suppress prices.”

North American Meat Institute Defends with Numbers

Grassley also made clear his concerns over what he sees as anti-competitive practices, as he says the four meatpackers control more than 80% of the cattle market today and hold a tremendous amount of market power. He also said “independent cattle producers in Iowa and across the country need a free and fair market.”

The North American Meat Institute (NAMI), which represents the meatpacking industry, also submitted testimony to the hearing, saying when it comes to talk about concentration in the industry, “the four-firm packer concentration ratio for fed cattle slaughter has not changed appreciably in more than 25 years.”

NAMI also says claims that the big four packers control 85% of beef production in the U.S. is a

misleading exaggeration. It says the number is more like 70%. The group also continues to say market fundamentals drive the cattle and beef markets.

Read the full testimonies here.