The Wall Street Journal: A Provocative Look at the Harm From Corporate Heft

A Whole Foods Market in New York City on the first day of Amazon’s ownership Monday already showed how the online giant is making its mark on the retailer, offering its Echo device at a discount. Photo: Richard B. Levine/Levine Roberts/Newscom/Zuma Press

By Greg Ip | Aug. 30, 2017

A new study finds that lack of competition has driven up prices, hurting U.S. growth, wages and labor-force participation

Corporate America is getting more concentrated. The country’s largest internet retailer just acquired its largest standalone organic grocer, and two of its largest aviation-parts makers plan to merge. From health insurance to internet search, fewer companies control more of their markets.

That can be good: size and scale can enable companies to reduce costs, invest in better products and compete globally. But a provocative new study concludes the opposite. It found that in recent decades a lack of competition has driven up prices, hurting U.S. growth, wages and labor-force participation.

The study is causing a stir among economists, some of whom are skeptical of its conclusions. Yet its basic finding is eye-opening.

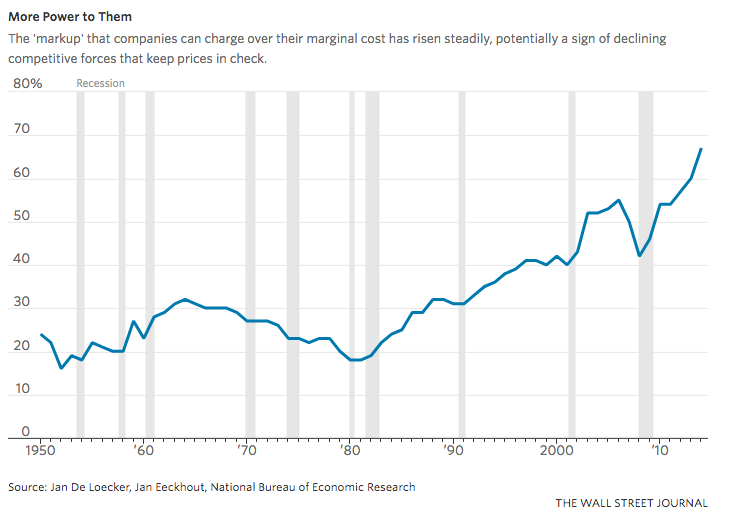

In the study, Jan De Loecker of Belgium’s University of Leuven and Jan Eeckhout of University College London start from the economic assumption that in a competitive market, a company can’t charge much more for a product than the cost of making one more (what economists call the “marginal cost”). If it did, another company would swoop in and undercut it.

The authors analyze data on every publicly traded company in the U.S. back to 1950 to determine how much its revenue exceeded its variable costs, such as labor and commodities. That excess, what they call the markup of price over marginal cost, fluctuated between 16 % and 32% until 1982 and has since climbed steadily, to 67%.The trend holds across industries, and is more pronounced in smaller rather than the biggest companies.

This, they say, is proof that companies are increasingly able to exert “market power,” that is, charge higher prices so as to boost profits at the expense of consumers.

Other studies have come to similar conclusions. One by former President Barack Obama’s Council of Economic Advisers found return on capital had become astronomical for the most profitable publicly traded companies, which shouldn’t be possible if competitors could freely enter their market.

The latest study goes even further, arguing the prevalence of market power helps explain deeper economic maladies. A company with such power often restricts production to prop up prices and profits. Messrs. De Loecker and Eeckhout argue this reduces demand for labor and thus explains why wages for low-skilled workers have stagnated in recent decades. Lower wages also discourage people from working, which depresses labor-force participation.

They add that markups may be evidence of barriers to entry by new competitors, which is corroborated by slumping business startup rates. The especially sharp rise in markups since 2009, they say, may explain why economic growth has been so tepid since.

The paper’s novel approach and audacious claims have attracted widespread attention in the blogosphere. Dietrich Vollrath, an economist at the University of Houston, calls it “an intriguing (and very large) step forwards.”

But some of its claims invite skepticism. Ample evidence already links depressed wages to globalization, weaker unions and the demand for skills. Growth has been weak globally since 2009 and seems due mostly to aging and repairing the damage of the financial crisis. The link to market power thus far appears mostly circumstantial.

By focusing on variable costs the authors may understate how companies’ fixed costs have risen, to pay for things such as software, computers, research and development and marketing. One major fixed cost, depreciation, has risen from 12% of GDP in the 1960s to around 16% as companies spend more on tech equipment that quickly becomes obsolete.

Tyler Cowen, a blogger and economist at George Mason University, writes that this might lead to more “monopolistic competition,” i.e., a handful of companies, each of which exercises some market power, without generating excessive profits because these companies have to invest so much. The study’s authors say profits have risen, but Mr. Cowen disputes their data.

One example of this is banks that now spend more on information technology to manage risks and to design and market products rather than on branches. This favors large banks that can spread those costs over many more customers. Cars, meantime, increasingly contain software that is costly to develop but almost costless to reproduce, such as Tesla Inc.’s self-driving software, an enhanced version of which the company sells as a $5,000 option.

The question for trust busters is whether this move toward companies with higher fixed costs and more market power is benign or malign. The policy implications are either “‘We’re being too lenient,’ which is what we heard in the corridors of Europe, or it could be, ‘Here’s the way business models are evolving,’” says Mr. De Loecker.

Last week, the Federal Trade Commission blessed Amazon.com Inc. ’s purchase of Whole Foods Market Inc., no surprise since the combined company would control only a small slice of the grocery market. And Amazon, whose profit margins are infamously thin anyway, immediately cut prices on dozens of items—a move sure to depress rather than raise markups.

Critics worry that once Amazon has eliminated competitors, it will be free to jack up prices or squeeze suppliers. Yet the very thing that in theory makes that possible—Amazon’s size—also justifies the investments in technology and real estate that make its offerings so irresistible to customers and difficult for competitors to match. For instance, Whole Foods doesn’t just give Amazon a big footprint in groceries, but a network of physical pickup locations close to its most affluent customers.

The latest study doesn’t resolve these tensions. But the questions it raises about how corporate size is reshaping the economy beg for further investigation.

Write to Greg Ip at greg.ip@wsj.com